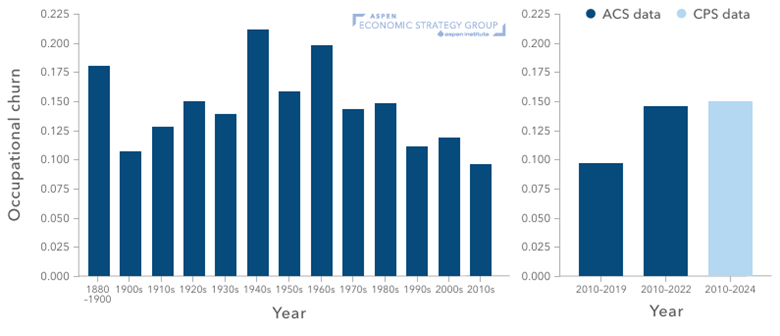

The labour market has been shifting beneath our feet, unbeknownst to the broader public and even policy makers. The changes predate any impacts we're seeing due to the ongoing trade war and even the explosion of generative AI. In a study published last October, Harvard researchers analyzed how rapidly jobs have changed in the U.S. since 1880 and how the labour market was impacted by previous waves of technological change. While this was an American study, there are clear parallels for the Canadian economy (which I’ll get to shortly). Specifically, the authors measured "occupational churn" or changes in the shares of occupations over time. Here’s what they found:

Over the past century, the three decades after World War II (between 1940 and 1970) were the most disruptive period in the history of the American labour market – driven in part by a continued shift out of farming. Since then, the labour market entered a relatively quiet period of lower churn, despite the proliferation of information technologies. In fact, the 1990s and 2010s were among the least disruptive decades on record. Data from 2020 onwards paints a different story. Occupational churn between 2010 and 2022 reflects close to a ~50% spike in churn compared to the 2010s alone– levels more in-line with the average change seen throughout the twentieth century.

Occupational Churn, United States of America, 1880 – 2024

Note: Occupational churn over each period is calculated as the sum of the absolute changes in employment share across 20 broad occupation groups. In other words, ‘churn’ reflects the total amount of change in occupation shares, irrespective of whether they went up or down. For example, if each occupation represented 5% of the workforce and the shares stayed the same from one decade to the next, churn would be 0. But if each of the group’s share changed by 1 percentage point (to either 4% or 6%), the churn would be .2 (20 groups x 1%).

Source: Deming, David, Christopher Ong, and Lawrence H. Summers. 2024. Technological Disruption in the U.S. Labor Market. Aspen Economic Strategy Group.

According to the authors, greater labour market volatility in recent years is in part due to 4 trends:

- A shift from job polarization (where high- and low-paid occupations are growing in share, but middle-skill occupations are not) to skill upgrading (only high-skill occupations are growing);

- Declining or stagnating employment in low-wage service occupations (think food prep, personal services, cleaning and janitorial services, etc.);

- Accelerated growth of STEM occupations (after a lull in the 2000s); and

- Declining jobs in retail sales

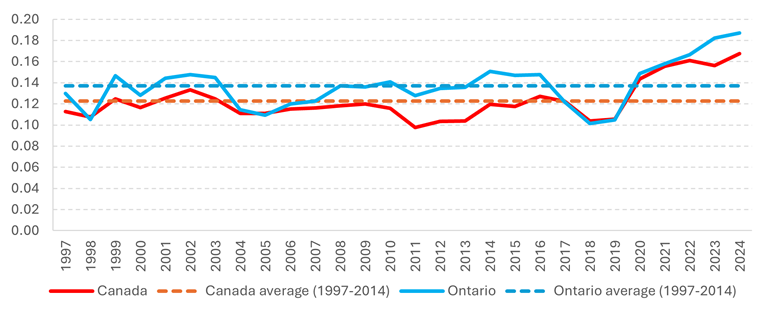

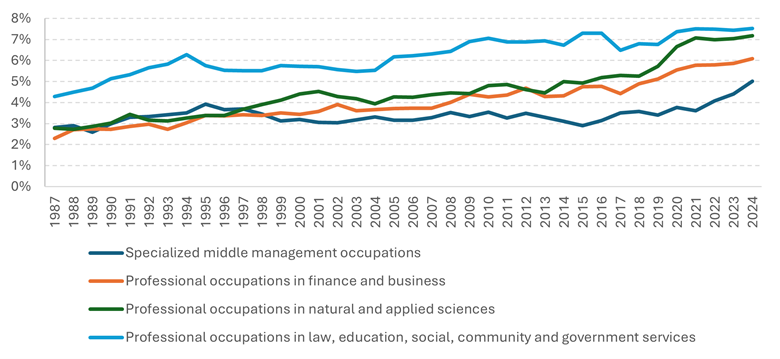

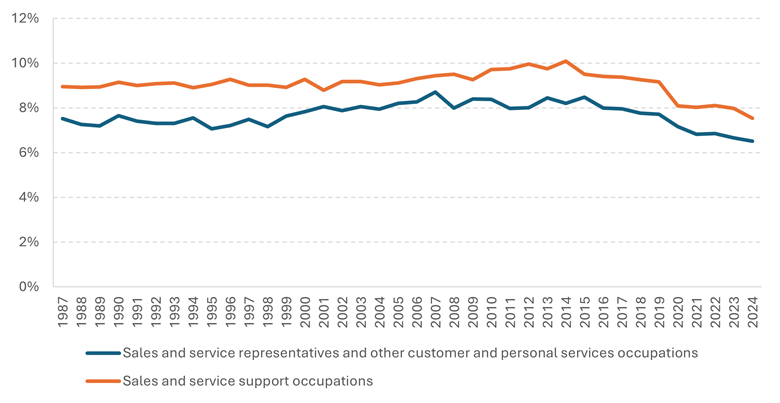

The Board replicated this analysis across 34 occupations in Canada and found that there is a similar story playing out here at home. In part induced (or accelerated) by the COVID-19 pandemic, occupational churn in Canada is at its highest levels since at least the late 1990s. In Ontario, occupational churn is even higher. Our preliminary analysis demonstrates some of the factors at play in the U.S. may also be driving change in Canada. In Ontario, two of the major sales and service occupation groups are now each 2 percentage points lower as a share of the total labour market than they were 10 years ago. Together they support 107,000 fewer jobs since 2019, when total employment grew by 730,000 jobs. At the same time, growth in professional occupations and middle management occupations accelerated post-2019.

Occupational Churn, Canada and Ontario, 1997 – 2024

Note: Occupational churn is measured as the sum of the absolute changes in employment share of 34 broad occupational categories from 10 years prior.

Source: Statistics Canada Table: 14-10-0416-01. Toronto Region Board of Trade Analysis.

Disruption often has a strong negative connotation, but like other periods of tech-driven labour market disruptions, the recent change has been a net-positive for the economy and workers overall. The declining sales and services occupations account for 2 of the 3 lowest paying occupation groups. As higher paying occupations have become more prominent, it seems these workers have moved up the skills ladder to better paying jobs. Technological change or automation, rising wages, a tight labour market, and general preferences since the pandemic are all likely contributors.

Share of select professional occupations, Ontario, 1987 – 2024

Source: Statistics Canada Table: 14-10-0416-01. Toronto Region Board of Trade Analysis.

Share of select sales and services occupations, Ontario, 1987 – 2024

Source: Statistics Canada Table: 14-10-0416-01. Toronto Region Board of Trade Analysis.

The findings presented are preliminary and certainly require additional detailed analyses to better understand how the Canadian labour market has changed in recent years. However, they do point to at least two key insights that governments and businesses must grapple with:

- Sometimes disruption is good (and inevitable) and policy must facilitate (as opposed to slow down) a change that enables workers to move to more productive, better paying jobs.

- It's unclear how the advent of generative AI will impact the labour market going forward – will we see sustained high occupational churn? The changes to the nature of work due to generative AI will likely be different than what was seen in the immediate post-COVID period, with many tasks replaced or at least highly augmented by AI.

History has demonstrated that, when adopted widely, General-Purpose Technologies like AI can be transformational for economic growth. However, they can also fundamentally change the structure of the labour market. To harness the full potential of AI, we’ll need to invest not only in the capacity of businesses to adopt and integrate the technology, but also in equipping workers with the skills need to thrive in tomorrow’s economy.

-

Saad Usmani

Director of Economic Research and Workforce Development

Saad Usmani is the Director of Economic Research and Workforce Development at the Toronto Region Board of Trade. Prior to the Board, Saad spent several years at prominent public policy think tanks in Ontario and most recently as a consultant in EY's Economic Advisory practice.

Saad's work supports the Board's efforts to improve business competitiveness and encourage broader economic growth in the region. This includes using data and research to better understand underlying business and economic conditions; advocating for policies and implementing initiatives that address our workforce needs; and developing approaches to best position key sectors and economic zones in the region for growth.