Toronto's economy is stalling, and its economic slowdown appears to be more prominent than other large metros in Canada. The Canadian economy may not be in a recession just yet but spending patterns in Toronto point to a weakening economy. More on a possible "T-cession" in a moment.

The second quarter GDP estimates for the Canadian economy were released at the end of August, indicating that it grew at an annualized rate of 2.1 per cent. Masking the headline number, however, were the details of what was driving that growth – much of it coming from government spending. Additionally, GDP per capita in fact fell for the fifth straight quarter. Weak economic activity was enough for the Bank of Canada to cut interest rates for a third consecutive time by 25 basis points last week, with more cuts likely to follow.

Contributing to the weakness in the economy is consumer spending. Per capita household spending is falling at a rate only seen during previous recessions and is now back to 2017 levels. While Canada is technically not in a recession as the economy collectively continues to grow, individual consumers are cutting back spending and acting as if we are – a situation economist Charles St-Arnoud refers to as a me-cession.

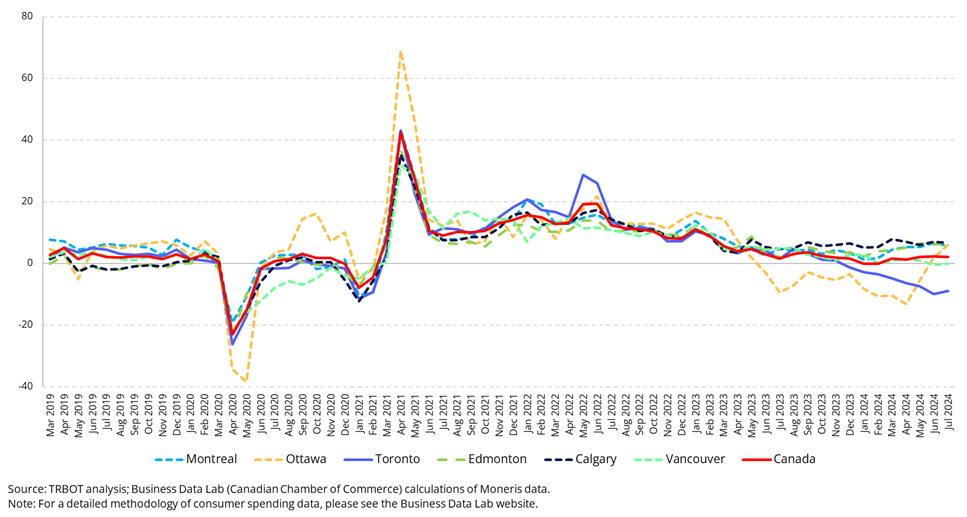

Total Spending Growth, Year-over-year % Change, Select Canadian Metropolitan Areas

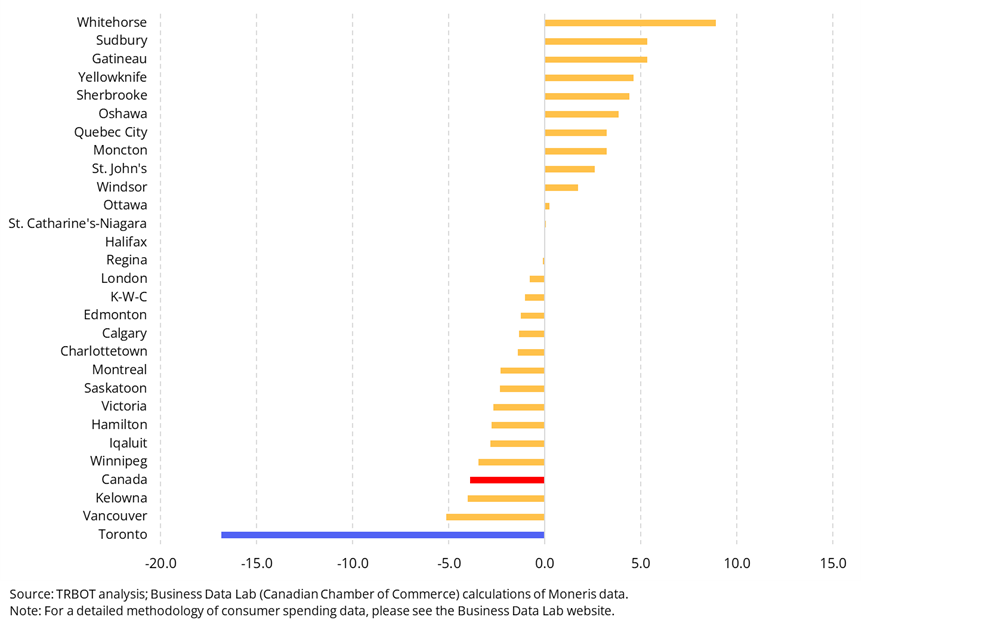

Toronto’s population may be booming, but its economy is showing signs of significant strain. First released back in May 2023, the Canadian Chamber of Commerce’s local spending tracker revealed that per capita spending was falling in 13 cities across Canada (including Toronto). At the time, total spending (and inflation-adjusted spending) in Toronto was still growing. Data from recent months signal a downturn in economic activity in Toronto – a “T-cession”. According to the estimates based on Moneris data, since November 2023, total spending in Toronto has been declining for 8 consecutive months with spending in July down 9 per cent relative to 2023 levels. As of July, Toronto has seen the steepest year-over-year decline across the metros in the dataset. The Ottawa metro also experienced an extended period of declining spending. Conditions in Toronto appear bleaker when looking at inflation adjusted per capita figures, with spending having declined 17 per cent since July 2023.

Real Spending Growth per Person, % Change from July 2023 to July 2024

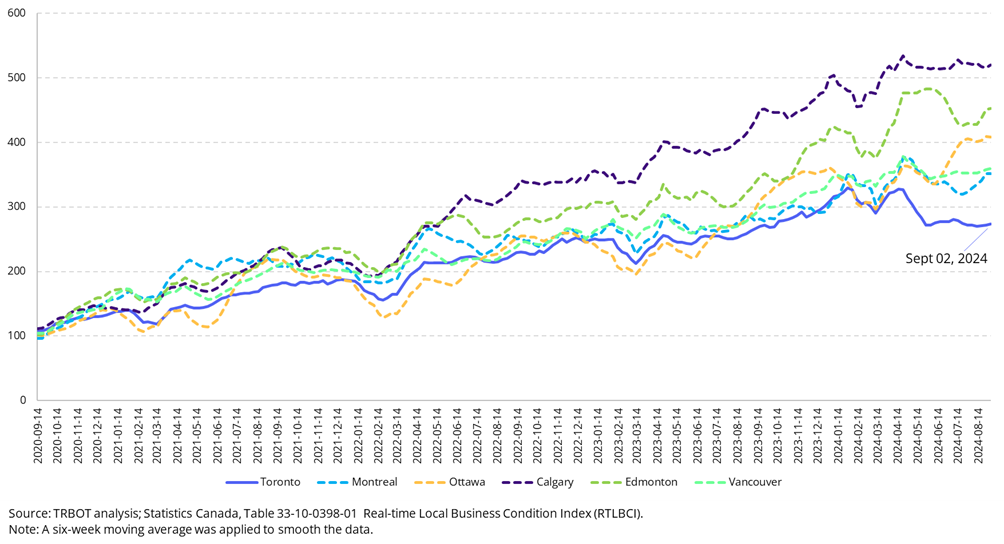

Another pandemic-era dataset corroborates the T-cession thesis. The Real-time Local Business Conditions Index, developed by Statistics Canada, provides a measure of business activity cross various Canadian cities. The index uses a combination of datasets measuring business size, business closures (using commercial APIs from platforms like Google Places and Yelp), and road traffic data (TomTom) to monitor changes in business activity at a local level. The index paints a similar story, with economic activity falling in Toronto since the start of the new year. In the face of tightening macroeconomic conditions, the other ‘big six’ metros across Canada have been more resilient.

Real-time Local Business Conditions Index, Aug 10 2020= 100, Select Population Centres

There is no one driver of the slowdown seen in Toronto. For one, Toronto residents have some of the highest levels of consumer debt in the country. High household debt was expected to weigh down spending in Ontario but was kept afloat in part as services spending was returning to pre-pandemic levels. High levels of indebtedness may finally be catching up to Toronto residents who are scaling back spending. Afterall, housing-related costs do eat up a significant chunk of Torontonian’s incomes – leaving less for other discretionary spending. Homeowners in Toronto have also faced a marked decline in home prices and as they feel less wealthy they’ve responded by curtailing spending. At the same time, the unemployment rate continues to creep up – rising from just under 6 per cent in early 2023 to 8 per cent last month.

Top-line macroeconomic statistics can hide underlying economic conditions. The regional spending data shows an especially concerning story for Toronto. Businesses and policy makers would do well to look beyond the headline numbers and also to pay attention to local economic data – including those put together by Statistics Canada and the Canadian Chamber of Commerce.

Secondly, there’s a growing pool of evidence that points to the negative impact of high housing costs on productivity, economic growth, and other critical challenges in our economies. Declining consumer spending data points to how that may be manifesting here in Toronto in terms of its impact on economic activity. While it remains to be seen how Toronto’s economy will continue to evolve in the coming months, it’s critical that we continue to push for policy change to enable improved housing affordability to avoid deep and prolonged cycles of economic pain.

Much of the Toronto Region Board of Trade’s attention is currently focused on Toronto’s long-term economic competitiveness, particularly on addressing its ongoing productivity gap through the Business Council of Toronto. Business cycle-related economic challenges are the other side of that coin and we’ll be looking to play an active role in supporting businesses navigating the choppy waters.

-

Saad Usmani

Director of Economic Research and Workforce Development

Saad Usmani is the Director of Economic Research and Workforce Development at the Toronto Region Board of Trade. Prior to the Board, Saad spent several years at prominent public policy think tanks in Ontario and most recently as a consultant in EY's Economic Advisory practice.

Saad's work supports the Board's efforts to improve business competitiveness and encourage broader economic growth in the region. This includes using data and research to better understand underlying business and economic conditions; advocating for policies and implementing initiatives that address our workforce needs; and developing approaches to best position key sectors and economic zones in the region for growth.