On March 23, the Canadian Chamber of Commerce released findings from the 2023 Q1 Canadian Survey of Business Conditions that provides data on business conditions in Canada, as well as business expectations and views on emerging issues. The Toronto Region Board of Trade’s Economic Blueprint Institute analyzed data for businesses in the Toronto Census Metropolitan Area (CMA) for a snapshot of current business sentiment in the region.

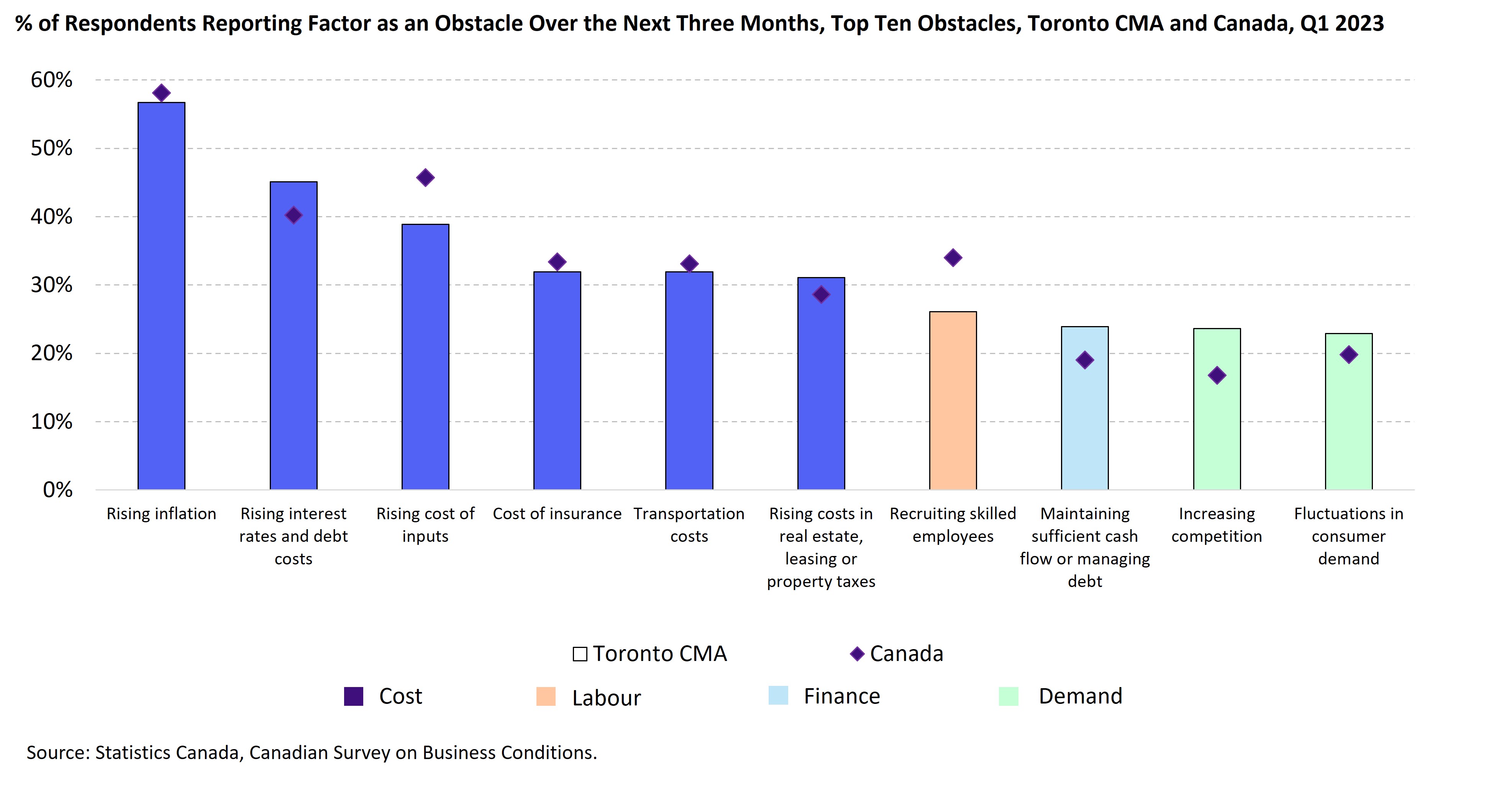

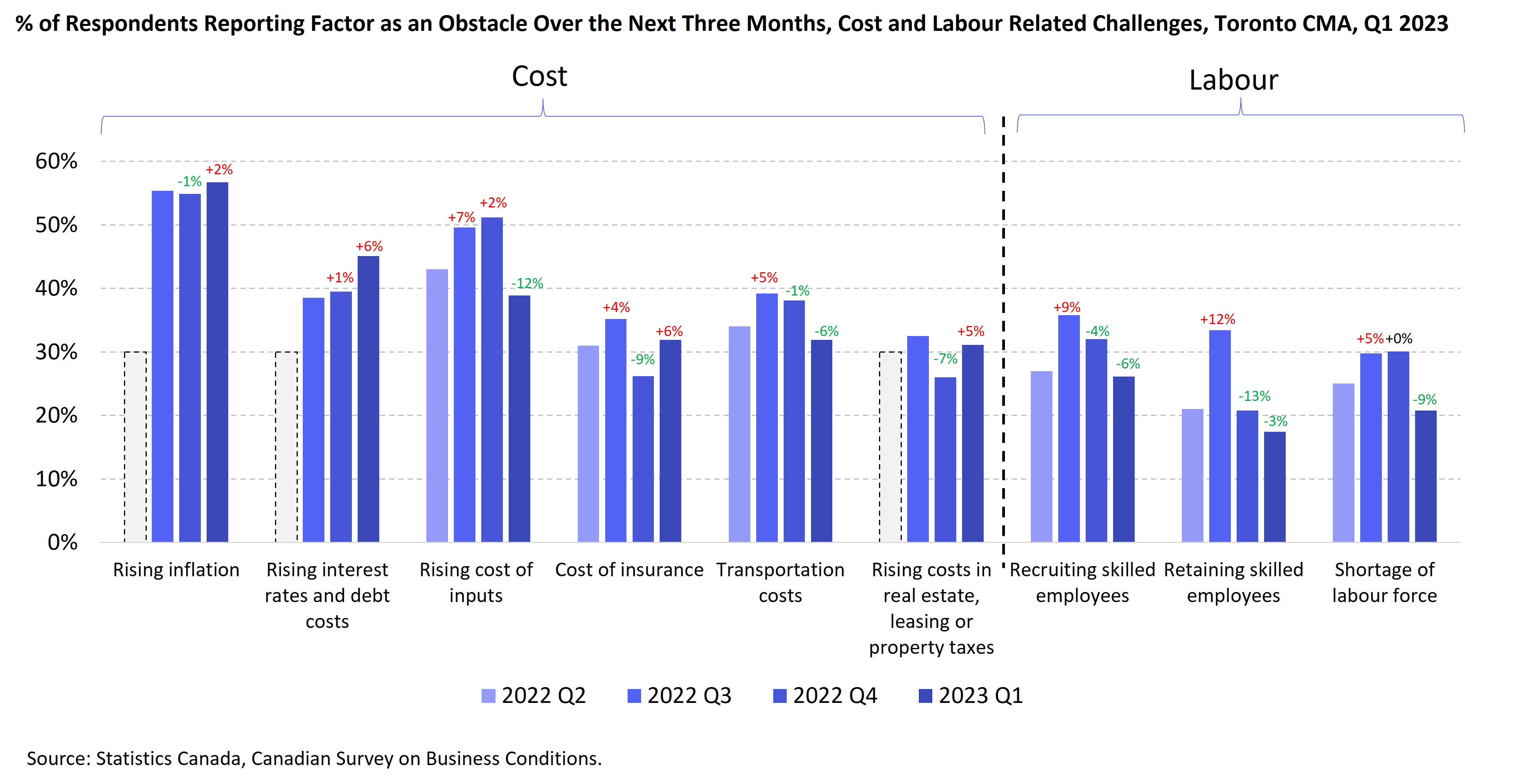

Rising costs remain top of mind for businesses across the Toronto metropolitan area in Q1 of 2023. In the latest survey cost-related issues make up the six most prominent challenges cited by Toronto businesses. Despite a slowdown in the inflation rate in the region, costs continue to grow beyond the Bank of Canada’s target range. While concerns about inflation and the rising interest rate environment, along with associated debt costs, remain elevated, other challenges linked to the pandemic have eased over time. Transportation and input costs have shown signs of improvement in the first quarter.

On the flipside, while labour challenges remain a significant hurdle for businesses in the region, they are notably less prominent in the Toronto CMA than elsewhere across Canada and have seen continuous improvement since the third quarter of 2022. This matches the trends seen for job vacancies in the Toronto economic region, where total vacancies and the vacancy rate have both been declining since the first half of 2022.

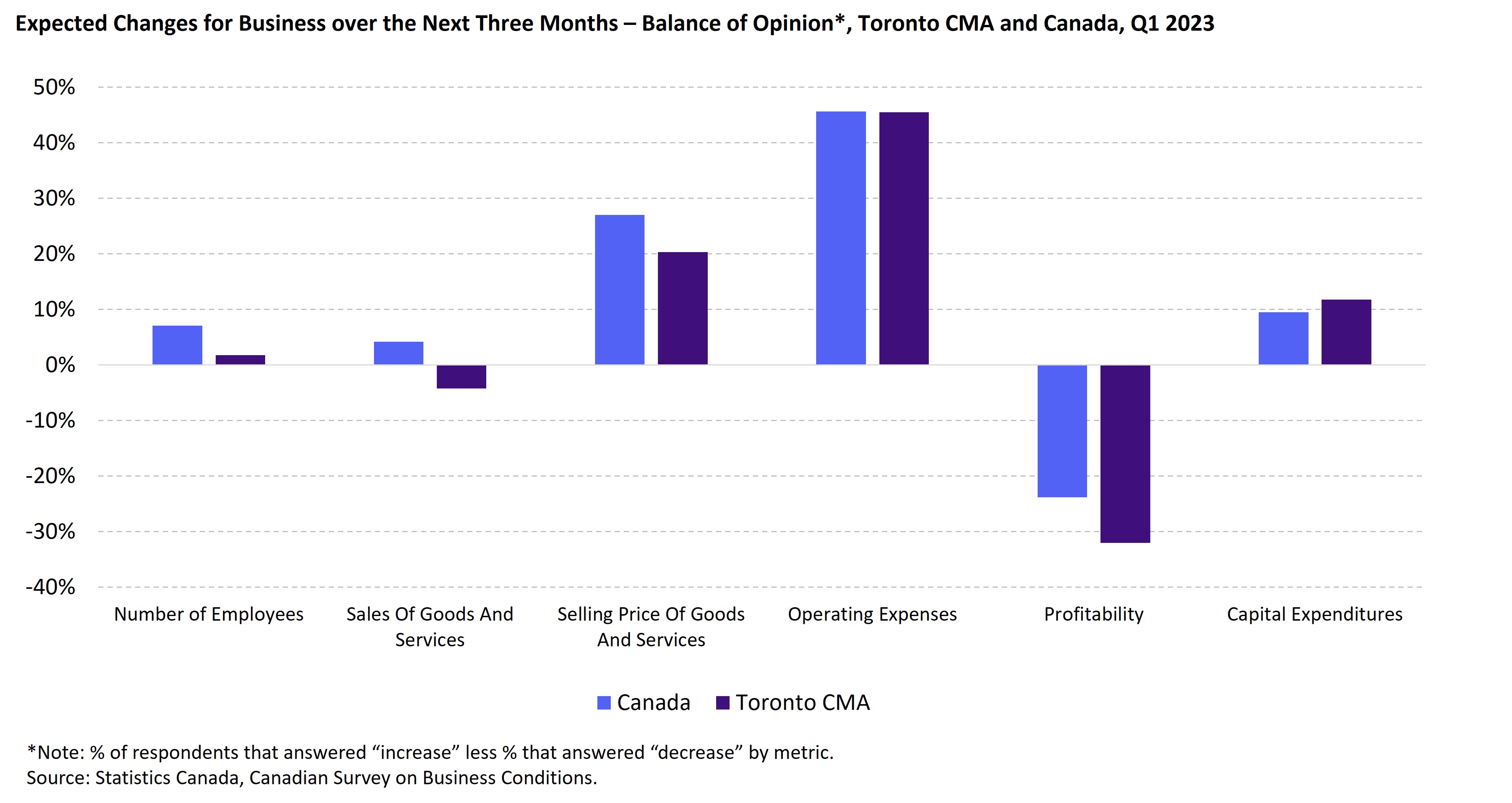

Most businesses (61%) surveyed in the Toronto CMA reported that their revenues in 2022 were at least as high, if not greater than, in 2021. This was a marked improvement from the survey results in 2021, which showed that only 36% of businesses reported revenues that were higher or the same as in 2019. Still, the outlook for revenue and other business health metrics remain unclear. On balance, more businesses expect their sales to fall than to rise in the short-term; employment growth is expected to be minimal; and profitability is anticipated to fall. The short-term outlook is generally gloomier for the Toronto CMA relative to the Canadian average.

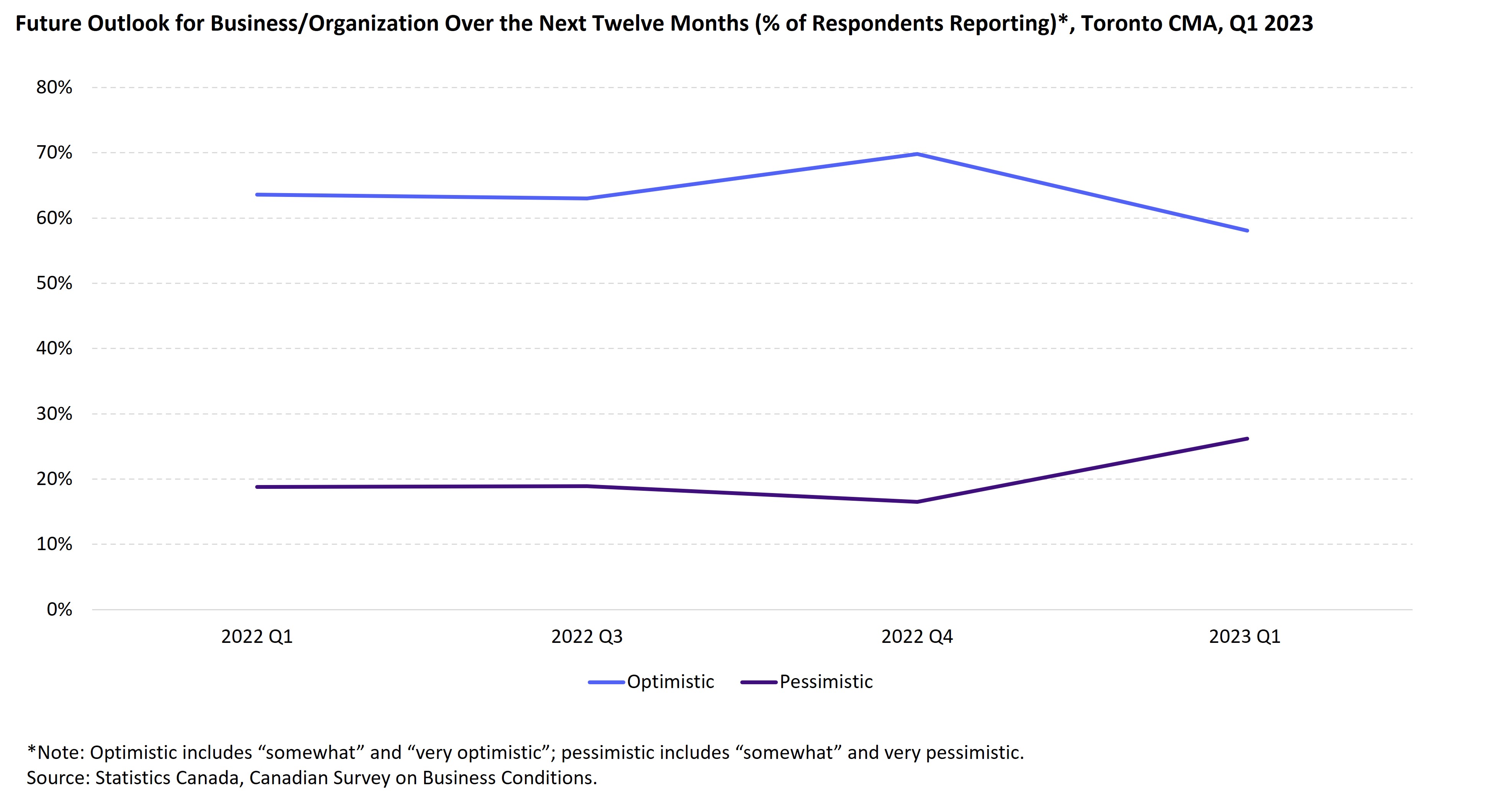

Most businesses (58%) in Toronto are optimistic about their outlook. However, in the face of a higher interest rate environment and rising economic uncertainty, the outlook for Toronto businesses has deteriorated since the last quarter. 26% of businesses reported feeling either very or somewhat pessimistic about the outlook for their business – up from 17% in the last quarter of 2022. Pessimism is higher among Toronto businesses compared to Canada as a whole (19%).

Close to a third of businesses in the Toronto CMA (32%) anticipate that their employees will work remotely for at least half of their hours over the next three months. These statistics have changed very little from the Q1 2022 survey. The latest mobility trends for workers demonstrate that worker volumes in the Toronto CMA remain well below pre-pandemic levels (-22% from January 2020 to January 2023) and may remain so in the near term. Still, we are seeing large employers like RBC mandate workers to come to the office on a more frequent basis (in RBC’s case, at least 3-4 days a week). If these policies are adopted more widely, then we may see workplace traffic get closer to pre-pandemic levels.

The Canadian Survey on Business Conditions (CSBC) was created in the spring of 2020 by Statistics Canada in partnership with the Canadian Chamber of Commerce to provide timely and relevant data on Canadian business conditions. The data is used by policymakers, chambers of commerce, boards of trade, industry associations and researchers to monitor evolving Canadian business conditions and trends. The 2023 Q1 CSBC was collected from January 3 to February 6, 2023. The survey was conducted by Statistics Canada via electronic questionnaire, using a stratified random sample of establishments with employees. The 2023 Q1 CSBC survey is based on responses from 15,963 Canadian employers.

The Canadian Survey on Business Conditions Report presents in-depth quarterly analysis of the CSBC conducted by the Canadian Chamber’s Business Data Lab. The Business Data Lab collaborates with the Canadian Chamber Network to distribute and amplify CSBC insights to the local level.

Saad Usmani is the Director of Economic Research at the Economic Blueprint Institute. Saad leads the institute’s efforts to develop data driven insights to help make Toronto among the top globally competitive business regions.